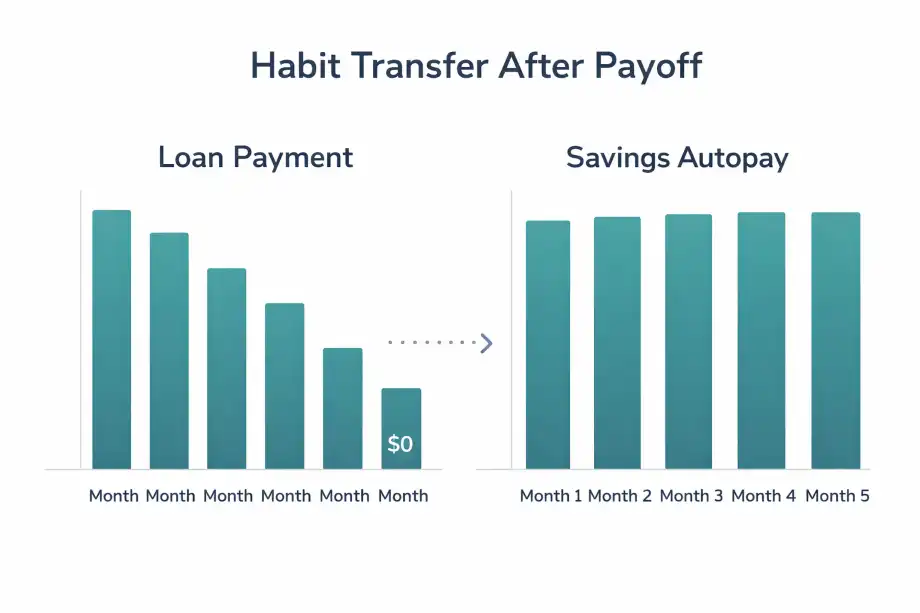

Loan Repayments Build Better Habits Than Savings Alone

This article reveals why loan repayments build better financial habits than savings alone, offering practical insights backed by real‑world scenarios and clear comparisons. Readers will discover how structured obligations create discipline, consistency, and accountability—skills that naturally transfer to long‑term savings success. With expert reasoning, comparison tables, and actionable strategies, this piece goes beyond generic advice to deliver genuine value. It’s a must‑read for anyone seeking smarter, habit‑forming approaches to personal finance.