Home Loan Hidden Charges : 7 Costs Banks Don’t Tell You About

Your home shouldn’t come with hidden surprises.

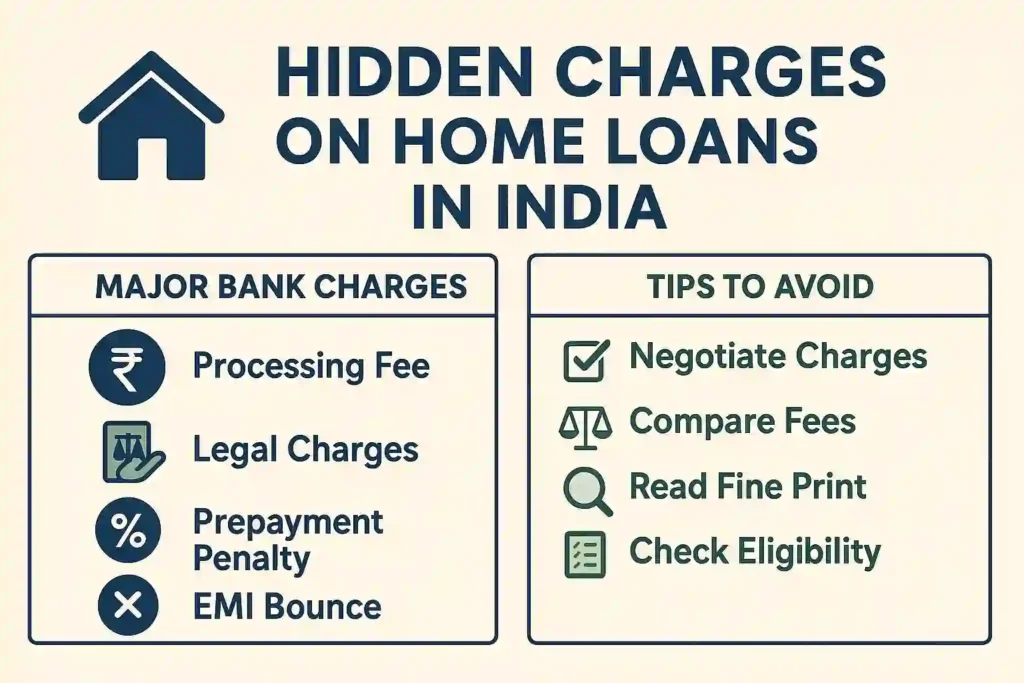

Buying a home is one of the most emotional and expensive decisions in life. But while everyone talks about interest rates, very few talk about home loan hidden charges that silently increase your total loan cost.

These bank charges are often buried in fine print. Many Indian residents and NRIs only discover them once the money is already deducted.

This detailed expose will help you uncover the truth, protect your money, and make smarter borrowing decisions using practical home loan tips and a final checklist.

Why Home Loan Hidden Charges Matter?

Most borrowers only compare interest rates. However, banks and NBFCs earn a large part of their money from non-interest bank charges.

Even a 1–2% hidden cost on a ₹50 lakh loan can translate into ₹50,000 to ₹1,00,000 extra from your pocket.

That’s why understanding home loan hidden charges is not optional — it’s essential.

1. Processing Fee – The First Silent Cut

Almost every bank charge a processing fee for handling your application.

Common charge:

0.25% to 1% of loan amount

Sometimes capped at ₹10,000–₹25,000

For a ₹50 lakh loan, even 0.5% = ₹25,000

Tip: Ask if they are running any seasonal waiver offers.

2. Legal & Technical Verification Charges

Banks verify property legality and valuation. They hire lawyers and engineers — but pass the bill to you.

Typical cost:

₹3,000 to ₹10,000

Sometimes more for large or NRI loans

These bank charges are rarely disclosed clearly upfront.

3. Loan Conversion or Switching Charges

If interest rates drop later, you may want to switch to a lower rate. But banks don’t allow it for free.

What they charge:

0.5% to 2% of outstanding loan amount

On a ₹40 lakh balance, this can mean ₹20,000–₹80,000

💡 Always ask: What is your loan conversion or reset fee?

4. Prepayment and Foreclosure Charges

Though RBI has waived prepayment fees on floating-rate loans for individuals, fixed-rate loans and NRI loans may still attract charges.

Possible charges:

2%–4% of outstanding amount

Mainly applicable in fixed-interest or commercial loans

🔗 RBI guidelines reference:

https://www.rbi.org.in

5. EMI Bounce Charges

If your EMI fails due to insufficient funds, banks charge penalties.

Common bounce penalty:

₹300–₹750 per bounce

Plus GST

Frequent bounces also hurt your CIBIL score, increasing future loan costs.

6. MODT Charges (Memorandum of Deposit of Title Deed)

Many borrowers don’t know about this.

Some states charge stamp duty for registering your property documents with the bank.

MODT charges:

Around 0.1% to 0.5% of loan amount

Can be ₹5,000 – ₹30,000, depending on state

This varies regionally in India.

7. Late Payment Penalty

Apart from EMI bounce charges, even a few days delay can attract late payment penalties.

Typical late fee:

2%–3% per month on EMI overdue

Plus, interest on the overdue amount

This compounds quickly if ignored.

Smart Home Loan Tips to Avoid These Hidden Charges

Here are practical home loan tips to reduce your losses:

- Always ask for a complete fee sheet before signing

- Negotiate processing fees

- Read the loan agreement slowly

- Ask about prepayment terms

- Choose floating rate if flexibility is important

- Keep your account funded to avoid penalties

Quick Checklist

Before finalizing your mortgage, verify:

Processing fee details

Legal and valuation charges

Conversion/switch fee

MODT charge or stamp duty

Prepayment terms

Foreclosure fee conditions

EMI bounce penalty

Late payment interest

Goods & Services Tax (GST) on fees

Any additional admin charges

Conclusion: Don’t Let Hidden Charges Break Your Budget

Most banks won’t openly discuss all home loan hidden charges. But now you’re equipped with knowledge.

A home loan is a long-term commitment. Even small hidden costs can snowball into lakhs over the years.

So before signing any loan, always:

✔ Ask questions

✔ Demand clarity

✔ Compare total cost, not only interest

Smart borrowers aren’t those who get loans fast — but those who get them wisely.

FAQs: Home Loan Hidden Charges

These are extra bank fees not clearly highlighted during loan discussions but charged during or after loan disbursement.

Yes, but banks must disclose them. Many still present them in fine print.

By requesting a complete fee structure, negotiating, and comparing lenders carefully.

Yes, if not clearly communicated upfront.

Sometimes yes. Many banks apply additional verification and admin charges for NRI loans.

In many states, yes. It depends on regional stamp duty laws.

Not on floating loans for individuals, but fixed or NRI loans may still have them.

Yes, with smart negotiation or choosing banks with zero-switch policies.

Some banks charge document retrieval or loan closure fees. Always confirm this.

You can use fee estimators or our smart tools or contact us.

Are you searching for the best loan offers?

We are here to help you