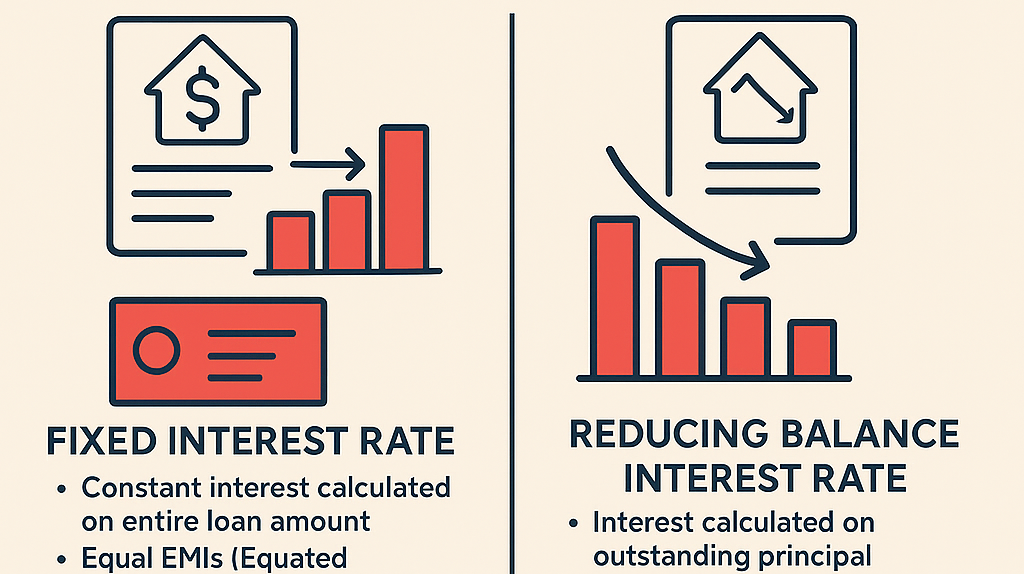

Borrowing money always comes with interest charges, which is essentially the “rent” you pay for using someone else’s funds. For first-time borrowers, grasping loan interest rates is crucial. In general, the total interest you pay depends on how the rate is applied. Two common structures are fixed (flat) interest rates and reducing balance (declining) rates. A fixed interest rate (often called a flat rate in some markets) is applied on the original loan amount throughout the loan term, whereas a reducing balance rate is applied on the remaining principal each month. Understanding fixed interest rate vs reducing balance rate:-

- Fixed (Flat) Interest Rate: Interest is calculated on the full original principal for every payment period. Your monthly payment (EMI) stays the same because the interest portion is fixed. This makes budgeting easier, since the EMI does not change over time.

- Reducing Balance Rate: Also known as the declining balance method, interest is charged on the outstanding loan balance each month. As you repay principal, the balance shrinks, so the interest portion of each payment decreases over time. Most modern loans (like mortgages, credit cards, and many personal loans) use this method.

Fixed (Flat) Interest Rate Explained

A fixed interest rate loan guarantees the same interest rate for the entire loan tenure. In practice, lenders using the flat rate method calculate total interest upfront on the original amount. For example, if you borrow $100,000 at a 10% flat rate for 5 years, the bank applies 10% to $100,000 for the full term. This makes calculating EMIs simple. In fact, one formula is:

Formula for EMI for a flat interest loan:

- EMI=P(1+I×T)/(T×12)

where:

- P = Principal (loan amount)

- I = Annual interest rate (as a decimal)

- T = Loan term in years

This formula calculates the fixed monthly installment by spreading the total cost (principal + total interest) evenly across all months in the loan term.

This method means each installment includes a fixed interest portion (on full principal) plus a fixed principal portion. Advantages include: stable, predictable payments (easy budgeting) and a straightforward calculation. Many borrowers like that the monthly EMI never changes. However, fixed-rate (flat) loans have drawbacks: they often lead to higher effective costs. Because interest never declines, the true annual percentage rate (APR) can be nearly double the quoted flat rate. For instance, a study notes that an 8% flat rate equates to about a 15% reducing-rate APR. Moreover, flat rates offer no benefit if market rates fall; you keep paying the full rate.

Fixed (Flat) Rate – Key Points:

- Interest on full principal throughout.

- EMIs remain constant, aiding budgeting.

- Often advertised as lower nominal rate (e.g., “flat 8%”).

Note: The effective interest (APR) can be much higher than the flat rate

Reducing (Declining) Balance Rate Explained

Under a reducing balance (declining) method, interest is charged only on the outstanding loan balance each period. Every payment you make first covers that period’s interest, then reduces the principal. As principal shrinks, the next period’s interest charge shrinks too. This method is more borrower-friendly in terms of cost.

For example, consider a $50,000 personal loan at 5.00% for 3 years. Using the reducing balance formula, the EMI works out to about $1,498.54. In the first month, roughly $208.33 is interest (on the full $50k), but by the last payment only about $6.22 is interest.

Formula for Reducing Balance EMI:

EMI = [{P×R×(1+R)N}/{(1+R)N−1}]

Where:

- P = Principal loan amount

- R = Monthly interest rate (Annual rate ÷ 12)

- N = Total number of months in the loan tenure

Advantages of reducing-balance loans include paying less total interest. In the above example, total interest using the reducing method is only $3,947.62 over 3 years, versus $7,500 under the flat method – a saving of $3,552. These loans also align the APR with the quoted rate (no hidden cost). The main downside is a bit more complexity in calculation and the fact that if the interest rate itself is variable, the EMI can change. But many borrowers appreciate that interest charges drop over time as they repay.

Calculating Personal Loan Payments – Example

To illustrate, let’s compare EMIs for a personal loan example:

- Loan: $50,000 for 3 years at 5% annual interest.

- Flat-Rate Method: Total interest = $50,000×0.05×3 = $7,500. Add to principal → $57,500 total, divide by 36 months → EMI ≈ $1,597.22.

- Reducing-Balance Method: Using the amortization formula (r = 0.05/12, n=36), we get EMI ≈ $1,498.54. In this case, total interest paid is only $3,947.62, which is $3,552 less than the flat-rate method.

This example (from SoFi) shows why reducing-balance loans often cost much less in interest than their flat-rate counterparts. Such calculations help you compare personal loan interest rates effectively

Global Perspectives on Interest Rate Structures

Different countries and lending sectors use these rate structures differently. In much of the developed world, consumer loans (personal, home, auto) generally use amortized reducing-balance calculations, often with either fixed or adjustable annual rates. The term “flat interest rate” is rarely used outside of Asia or microfinance. By contrast, in parts of Asia, Africa, and among microfinance institutions, flat-rate loans are quite common. For example, MFTransparency notes that two main methods in microloans are precisely the declining (reducing) and flat rate methods. Historically, flat-rate loans were popular before modern banking: one analysis notes that they “continued to feature up to the 20th century” in developed countries and now persist in the informal economies of developing regions.

- In India and nearby markets, many banks and informal lenders advertise flat interest rates for auto, education, and personal loans. However, financial experts warn borrowers to calculate the effective rate, since an attractive flat rate can mask a much higher APR.

- In the USA and Europe, most lenders automatically calculate interest on the outstanding balance (reducing method) even if they market the loan as “fixed-rate” in the sense that the nominal rate doesn’t change. Thus, consumers there usually see lower effective interest.

- Microfinance often relies on flat rates for simplicity, but organizations like MFTransparency encourage switching to declining balance for transparency. In practice, borrowers worldwide pay attention to both the quoted rate and the calculation method.

In summary, global practice varies: developed markets favor reducing-balance amortization, while some emerging markets and micro-lenders still use flat-rate quotes. Understanding local norms and regulations is important. For example, Moneycontrol highlights that lenders should disclose the reducing balance or APR, since flat rates understate the true cost.

Understanding Fixed vs Reducing Balance Interest Rates Differences

| Criteria | Fixed (Flat) Rate | Reducing Balance Rate |

| Interest Basis | Charged on full original principal | Charged on outstanding balance |

| EMI/Payout Stability | Very stable: EMI stays constant | Variable: payment or interest portion declines |

| Total Interest Cost | Higher: APR often ~2× flat rate | Lower: pays interest on reducing balance |

| Calculation | Easy: simple flat formula | Complex: requires amortization math |

| Beneficial When | Predictable budgeting, rising market rates | Minimizing cost, early repayment |

| Budgeting & Planning | Predictable payments (good for budgets) | Predictable EMI slightly less, but predictable reduction in interest |

| Hidden Costs | Risk: Actual APR is higher; flat rates can mislead | Transparent: APR matches quoted rate |

Expert Perspectives and Borrower Advice

Financial experts and borrower advocates often stress clarity and context when choosing a rate. For instance, S. Ravi (former BSE Chairman) notes that a fixed rate “remains the same throughout the term, making it easier for borrowers to budget”. On the other hand, Nehal Gupta (AMU Leasing) explains that with a reducing rate, “the outstanding balance decreases, and so does the interest charged,” which can save money. In short, experts agree that fixed rates boost stability, while reducing rates can lower costs.

Real borrowers frequently report confusion over “flat” vs “effective” rates. Consumer advisories (and regulatory bodies) often encourage comparing the effective interest rate (APR) rather than just the nominal flat rate. As Moneycontrol’s analysis warns: lenders offering very low flat rates might switch you to a reducing-balance APR that reflects the true cost. In practice, informed borrowers do the math: for example, if you see a personal loan advertised at 10% flat, you should verify what the equivalent APR is using an amortization schedule.

Key takeaway from experts: Don’t focus only on the stated rate. Ask the lender whether the interest is on a flat or reducing balance basis, and compare the APR. Use tools (like online EMI calculator) or examples to see which option is cheaper for your loan size and term.

Which Rate is Best for First-Time Borrowers?

First-time borrowers should balance simplicity against total cost. If budgeting certainty is paramount, a fixed (flat) rate loan gives the comfort of unchanging payments. This can be helpful for young borrowers who want to lock in their payments. However, you must remember that this convenience can cost you: flat loans usually mean a higher effective rate (APR).

Conversely, if you want the lowest overall interest payment and don’t mind a bit more math, a reducing-balance loan is often the better option. It can save thousands of dollars (or other currency) over the loan life. This is typically the “best interest option” financially, especially when you plan to repay steadily or if prepayments are allowed (because you immediately cut interest costs).

Ultimately, the “best option” depends on your situation. First-timers should ask:

- Can I handle a slightly variable payment or changing interest share?

- Do I have discipline to use a more complex loan calculator or tool?

- How might market interest rates move during my loan?

There’s no one-size-fits-all. Many financial advisers recommend running both scenarios for your personal loan. Compare the quoted flat rate against the amortized (reducing) rate to see actual differences. Use online comparison charts or even a quick spreadsheet. The small effort can reveal which loan is truly cheaper.

Conclusion (Understanding fixed interest rate vs reducing balance rate)

Understanding fixed interest rate vs reducing balance rate is vital for any borrower, especially first-timers. We’ve seen that fixed (flat) interest rates offer predictability, while reducing balance rates deliver savings over time. By comparing personal loan interest rates carefully – checking both the nominal rate and how interest is calculated – borrowers can avoid surprises and choose the best loan for their needs.

If you found this guide helpful, please share it with others who may benefit. Have questions or personal experiences with fixed vs reducing interest loans? Leave a comment below – your insights help our community learn. For more on managing loans and smart borrowing, explore our related posts on personal finance. Happy borrowing!

If you have read this article, You already know the following

- How fixed vs reducing interest rate affects EMIs

- Reducing balance method vs flat rate method

- Best interest rate method for personal loans

Read Also How Your Credit Score Impacts Loan Eligibility and Interest Rate Criteria

Good content and Informative post